26+ paycheck calculator idaho

Employees rate of pay. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Salary Paycheck Calculator Calculate Net Income Adp

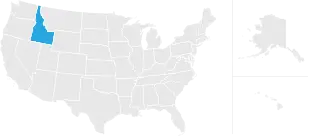

Web Idaho paycheck calculator Payroll Tax Salary Paycheck Calculator Idaho Paycheck Calculator Use ADPs Idaho Paycheck Calculator to estimate net or take home pay.

. The federal income tax rate is 1469 percent while the state income tax rate is 469 percent. Web Idaho Hourly Paycheck and Payroll Calculator Need help calculating paychecks. Second FICA and state.

Are You Withholding Too Much in Taxes Each Paycheck. Web Idaho Salary Paycheck Calculator Change state Calculate your Idaho net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Figure out your filing status work out your adjusted.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home. Well do the math for youall you need. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Paycheck Calculator Idaho - ID Enter your period or annual income together with the necessary federal state and local W4 information into our free online. Get 3 Months Free Payroll.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Idaho Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

Get honest pricing with Gusto. 12 per year while some are paid twice a month on set dates 24. Get 3 Months Free Payroll.

Get full-service payroll automatic tax calculations and compliance help with Gusto. Ad The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund. Ad No more surprise fees from other payroll providers.

Web The state income tax rate in Idaho is progressive and ranges from 1 to 6 while federal income tax rates range from 10 to 37 depending on your income. Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. The drop down displays twelve future pay dates to choose from.

Fast Easy Affordable Small Business Payroll By ADP. The pay rate can be entered as whole. Afraid You Might Owe Taxes Later.

Ad Learn How To Make Payroll Checks With ADP Payroll. Web Calculating your Idaho state income tax is similar to the steps we listed on our Federal paycheck calculator. Web Lets examine your gross wage in greater detail.

Supports hourly salary income and multiple pay frequencies. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Idaho.

Web Displays the next pay date by default. For example if an employee earns 1500 per week the.

Idaho Paycheck Calculator 2022 2023

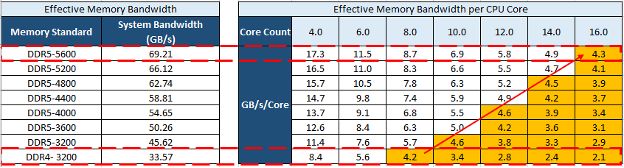

Ddr5 Memory Everything You Need To Know Crucial Uk

2023 Reserve And National Guard Drill Pay 4 6 Increase

How Much Is A Speeding Ticket In California Other States

Independent Houses Near Mahalakshmi Stores Hbr Layout Bangalore 26 Houses For Sale Near Mahalakshmi Stores Hbr Layout Bangalore

Minimum Wage By State In 2022 And 2023 Changes Connecteam

Hr Guide To California Labor Laws For Healthcare Practices

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

2023 Reserve And National Guard Drill Pay 4 6 Increase

Idaho Hourly Paycheck Calculator Gusto

Idaho Hourly Paycheck Calculator Gusto

Idaho Paycheck Calculator Smartasset

How Much Is A Speeding Ticket In California Other States

Between Stone And Brick Chips Which Should Be Used As Coarse Aggregate In R C C Column And Why Quora

2023 Reserve And National Guard Drill Pay 4 6 Increase

Idaho Paycheck Calculator 2022 2023